- Sections

- Ruby

- Web Development

- Artificial Intelligence

- Urban Planning

- Astronomy

- Issue Navigation

- Previous Issue

- Next Issue

Saturday, August 09, 2025

The Digital Press

All the Bits Fit to Print

Saturday, August 09, 2025

All the Bits Fit to Print

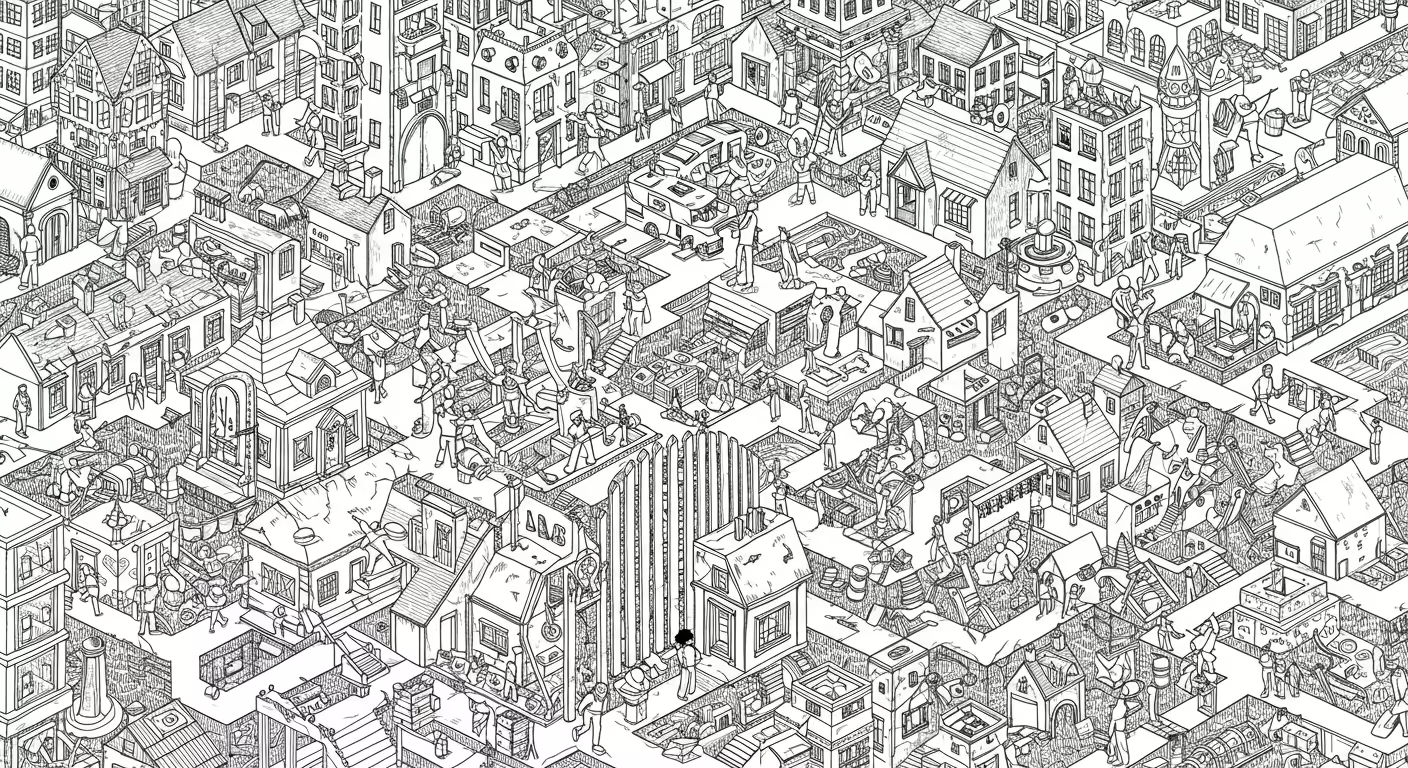

Examining the multi-decade challenges facing young homebuyers in the U.S. housing market.

The housing market for young Americans has become extremely difficult, with first-time homebuyers now typically in their late 30s instead of late 20s, making homeownership a distant dream for many. This crisis stems from decades of restrictive zoning, economic setbacks, and recent pandemic-related supply and demand shocks.

Why it matters: Young people struggle to buy homes, affecting life milestones like marriage and family formation, and impacting economic and social stability.

The big picture: Half a century of zoning restrictions, a construction industry collapse after 2008, and pandemic-driven inflation have all combined to push housing costs beyond reach.

The stakes: High prices, soaring mortgage rates, and limited housing supply trap young buyers, worsening wealth inequality and fueling generational disillusionment.

Commenters say: Many emphasize the need for deregulation and point to entrenched local resistance as key barriers; some reflect on shifting cultural and economic dynamics since the 1970s.