- Sections

- Ruby

- Web Development

- Artificial Intelligence

- Urban Planning

- Astronomy

- Issue Navigation

- Previous Issue

- Next Issue

Friday, October 24, 2025

The Digital Press

All the Bits Fit to Print

Friday, October 24, 2025

All the Bits Fit to Print

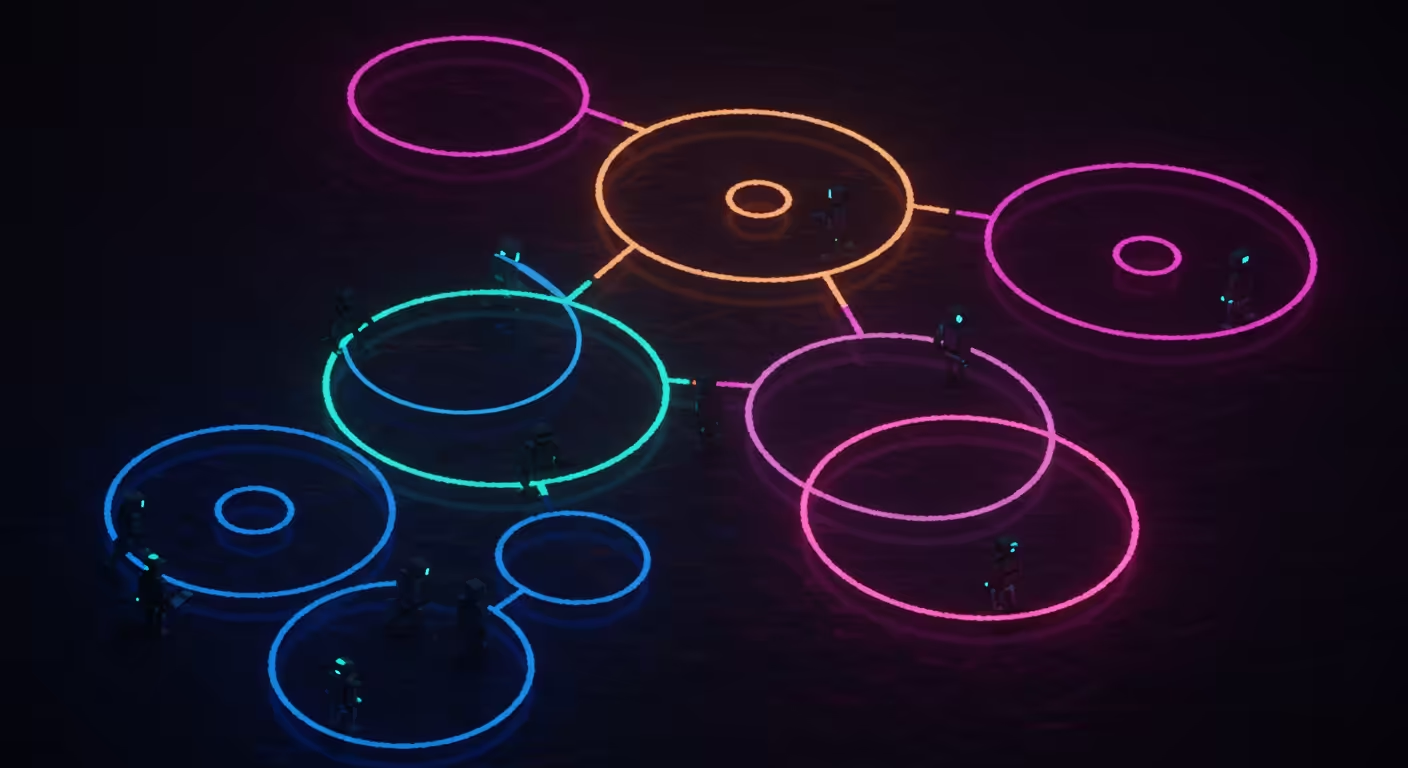

Analysis of AI sector’s interlinked investments and financial risks

AI companies and chipmakers are engaging in complex financial arrangements where they invest in each other and buy products in circular patterns, raising concerns about whether these deals artificially inflate revenues or increase systemic risk.

Why it matters: Circular deals could mislead investors about AI companies' true financial health and contribute to an eventual market bust.

The big picture: These intertwined investments reflect the broader high-stakes AI boom, with companies doubling down on an uncertain but promising technology.

The stakes: If AI fails, companies like Nvidia face massive losses both from product sales and equity investments, amplifying financial risk.

Commenters say: Many caution that vendor financing here signals weaker-than-expected demand and unsustainable growth, warning this could foreshadow a painful bust.