- Sections

- Ruby

- Web Development

- Artificial Intelligence

- Urban Planning

- Astronomy

- Issue Navigation

- Previous Issue

- Next Issue

Friday, August 08, 2025

The Digital Press

All the Bits Fit to Print

Friday, August 08, 2025

All the Bits Fit to Print

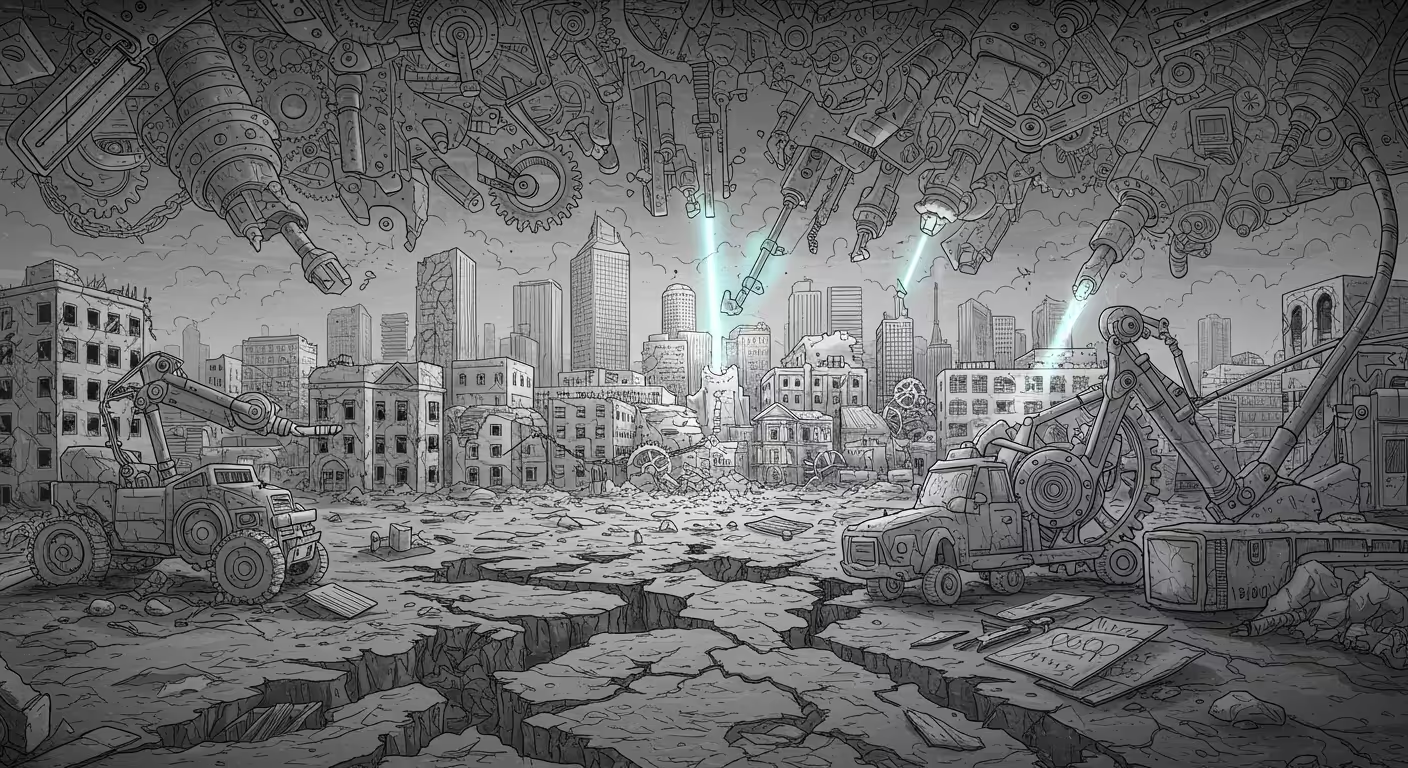

Baltimore undervalues vacant lots, encouraging blight and shifting tax burdens.

Baltimore significantly undervalues vacant lots for tax assessments, sometimes by as much as half a billion dollars, unintentionally encouraging land speculation and blight. A new report suggests simple, data-driven reforms to better align assessments with market values and promote neighborhood revitalization.

Why it matters: Undervaluing vacant lots subsidizes blight and shifts tax burdens unfairly onto homeowners and businesses.

The big picture: Correcting land assessments could unlock development incentives, stabilize neighborhoods, and improve city finances.

Quick takeaway: A spatially weighted average model using nearby sales data better predicts vacant lot values, reducing undervaluation drastically.

Commenters say: Many highlight the need for land value taxation reforms and improved data, while others debate risks of raising taxes and the complexities of urban development incentives.